3iQ

Services

- Strategy

- Brand Identity

- Social Media Assets

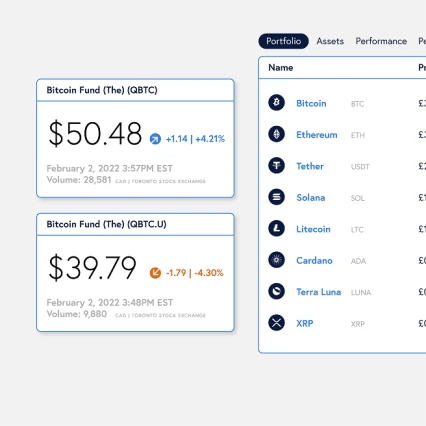

- Digital Design

Crypto investing can be complicated and opaque. Could Canada’s largest digital asset investment fund manager use brand to help clients find their way in a new financial landscape?

3iQ have charted the course for digital asset investors, with ten years’ experience in a new and emerging asset class. They have a history of innovation, bridging the traditional finance and digital asset worlds while ensuring rigorous regulatory compliance.

Working with institutions, advisors and high–net–worth individuals, 3iQ has developed a reputation for making digital asset investment accessible and understandable.

There is a perception problem around digital assets. They are not well understood. Scare stories abound, and there are plenty of fly–by–night operators making big promises. It’s not surprising that some investors are hesitant, or unsure how to incorporate crypto into their portfolios.

For 3iQ, who are creating institutional grade investments, it was important to educate investors about the benefits of digital, and build confidence in a new and unfamiliar asset class. Their brand needed to distinguish them from their competitors, while building trust and authority.

3iQ came to Sparks having already thought a lot about their brand. They had run an analysis of its strengths and weaknesses, and they had done some competition research and compared their brand to others in a similar space.

We helped them to refine their understanding of what made them good at what they do – the fact that 3iQ are digital natives, for example, and not an established firm trying to make room for digital assets within their traditional structures. That gives them a creative edge, a willingness to innovate, and the agility to adapt and learn. They also had a reputation for working with regulators to keep pace with the technology, and were the first digital asset manager in North America to list funds on a major stock exchange.

We were able to focus in on 3iQ’s role as an industry innovator. Here was a company that didn’t just know routes into digital asset investing – they helped to create those routes. They were cracking the complexity and making paths that others could follow.

Transformation

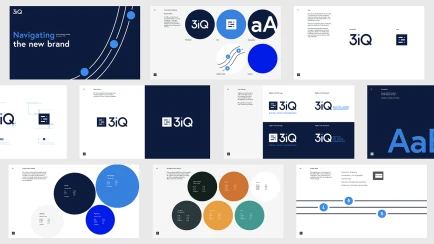

The final brand relies on 3iQ being a short and simple enough name to serve as a wordmark. This is displayed alongside an icon composed of dots and dashes. This hints at Morse code, the world of cryptography and deciphering, while also including the letter ‘i’ repeated three times. (The three ‘i’s stand, incidentally, for ‘Innovative, investments of institutional quality.’) The addition of a highlight colour distinguishes the brand among its competitors.

The pattern of dots and dashes is extended into supporting graphical assets that can be used in a variety of ways, creating pathways, suggesting flows of information or nodes in a network. With clean and modern sans–serif typefaces, the 3iQ brand feels sharp and clear – the complex world of crypto investing rendered simple and accessible.

Take a look at more of our brand work in the financial services sector.